PLAN YOUR RETIREMENT WITH US

No other stage in life requires as significant financial decisions as the period just before retirement. With proper preparation and professional advice, you can comfortably plan your retirement and save a substantial amount for your post-retirement life.

A few years before retiring, it’s crucial to engage deeply with your retirement plans. After all, retirement can be flexibly structured. You choose how to transition from working life and how to manage your pension capital and annuities. Your decisions will determine:

- The amount and duration of benefits from the AHV (Old Age and Survivors’ Insurance) and pension funds,

- The tax burden before, during, and after retirement,

- Financial protection for your spouse and children,

- The rate of consumption or growth for your assets.

Finding the optimal balance can be challenging due to complex legal regulations and the advantages and disadvantages inherent in every decision. The right retirement process is personal and depends on numerous factors, including:

- Expected AHV pension and applicable regulations,

- Anticipated benefits from the occupational pension plan and the rules of your pension fund,

- Your health condition and life expectancy,

- Your family situation,

- Your income and net assets,

- Your future goals and desires.

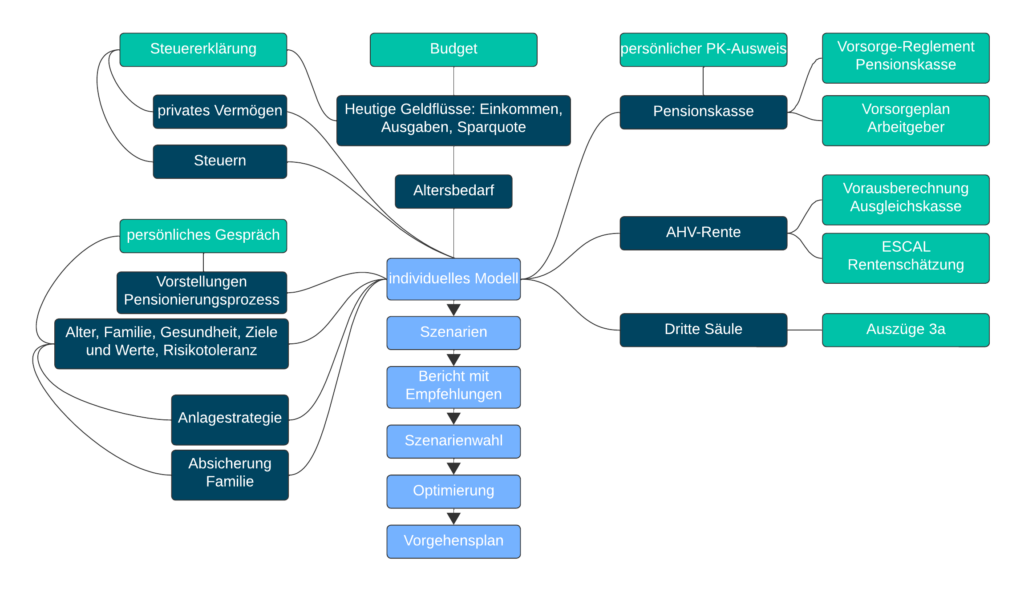

Ogi Trust has developed a unique retirement model. With it, we can simulate your personal pension situation and calculate the financial consequences of your decisions. With our guidance, you make informed choices, gain confidence in decision-making, and save significantly for your retirement.

QUESTIONS TO CONSIDER

How will you retire from your professional career?

Should you gradually reduce working hours? Is early retirement worth considering? Or, does it make sense to delay retirement? Most importantly: can you afford to retire? We calculate the financial impact of your desired retirement process and present alternatives.

When is the optimal time to start drawing AHV pensions?

With the AHV Reform 21, you can flexibly draw your AHV pension starting in 2024. We calculate the best time to maximize your pension income, depending on factors like gender, year of birth, life expectancy, and decisions regarding pension fund withdrawals.

How should you take pension fund benefits?

You can choose between a pension, lump-sum payment, or a combination. Do you need a reliable monthly pension income, or is a capital withdrawal more beneficial? Your choice affects your financial security, family provision, tax burden, and wealth growth. We compare the options and help you save taxes with an optimal, staggered withdrawal plan.

Should you make voluntary purchases into the pension fund?

Whether purchasing additional benefits into the pension fund is worthwhile depends on factors such as the time until retirement, the desired form of withdrawal, your tax burden, and alternative investment opportunities. We are happy to calculate the optimal purchase plan for you.

When should you withdraw third pillar assets?

You can minimize capital withdrawal taxes with staggered withdrawals from the third pillar. We calculate the optimal withdrawal plan for you, considering withdrawals from the pension fund.

Asset Management in Retirement

What do you plan to do with your available assets? Should you pay off your mortgage or invest in a portfolio? And how much risk capital is available in old age? Even in later life, you can invest money without jeopardizing your financial security. We show you how to manage existing funds in a risk-conscious and cost-effective way.

Financial Protection for Dependents

Do you have a spouse or children and wish to secure them financially? This can be done through pension schemes. Testamentary benefits or lifelong housing and usufruct rights to real estate are also viable options. In doing this, inheritance tax must be considered.

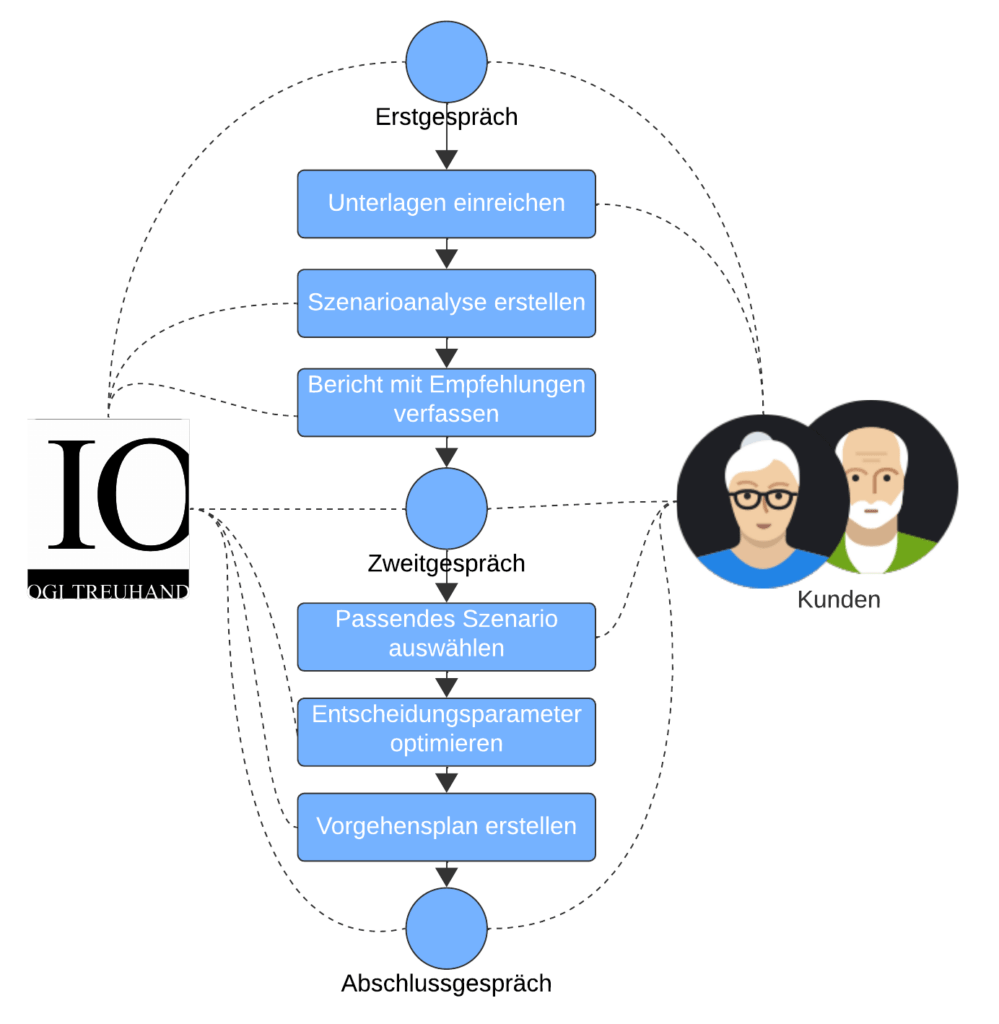

THE RETIREMENT PLANNING PROCESS

We guide you through the necessary steps of retirement planning.

- Assessment of your individual situation: In an initial discussion, we jointly analyze your financial and family background, your desires and preferences, and your risk tolerance. You provide us with all relevant documents. From this, we model your individual retirement provision situation.

- Formulation and calculation of alternatives: We create a personalized scenario analysis for you. In it, we calculate the financial consequences of impending decisions. You will receive from us a tailored report with recommendations for your retirement. Different scenarios have advantages and disadvantages. We present to you the design possibilities and their financial consequences in a second conversation.

- Decision-making: The choice is yours. Take your time to reflect. We are at your disposal for questions and further clarifications. You choose the alternative that suits you best.

- Conclusion: We optimize the scenario that suits you and create a concrete retirement plan for you with all necessary steps. In a final meeting, we clarify any remaining ambiguities. Upon request, we are happy to assist you in defining your investment strategy for retirement.

GET IN TOUCH

Determine the cornerstones of your retirement planning with us in a free initial consultation. We are happy to prepare an individual offer for you. Prices are based on the expected effort and differ between individuals and couples.