Straightforward Recommendations for Long-Term Investments – Quick Riches Don’t Exist

Only about one-fifth of the Swiss population invests their money directly in stocks. The concept of investing is unfamiliar to many. The main reasons for this are a lack of interest, a lack of knowledge, discomfort due to the associated risks, and bad experiences.

The imparting of financial skills is a matter close to our hearts. We believe that participation in the capital market should not be reserved for the wealthy alone. At the same time, we observe a wide array of opaque financial products and services with exorbitant fees. The market is saturated with financial service providers that are more interested in profit extraction.

As an independent trust office, we recommend long-term, broadly diversified, and passively managed investment solutions. Our recommendations are based on academic theory and empirical evidence regarding financial markets. Practical applicability in everyday life is important to us.

This article summarizes the insights and recommendations from our course “Wealth Accumulation for Your Future.” Interested readers can find the course slides in the download section on our website (german only).

“As an independent trust office, we advocate for long-term, broadly diversified, and passively managed investment solutions.“

Choose Funds Over Securities

Instead of seeking out individual securities, consider investing in funds. This approach saves time, reduces stress and fees, lowers your risk, and grants access to assets that might otherwise be out of reach.

“If professional funds can’t generate excess returns through active selection of stocks, what makes you think you can?”

Through a real estate fund, you can participate in the property market without buying an entire house. Some stocks are priced so high they are virtually unaffordable. A legendary example is Lindt & Sprüngli’s stock, trading at over 100,000 Swiss Francs per share. Even stocks costing several hundred Francs can tie up a significant portion of your investment if you’re on a modest budget. Individual stock create an undesirable concentrated risk. By purchasing a share in a fund, you join many other investors in owning a slice of the underlying assets. Suddenly, with modest capital, you’re a co-owner of numerous properties or businesses.

Broad-based investments diversify your risk. You become less dependent on the performance of individual properties or companies. A fund, depending on its focus, is already widely invested. You no longer need to worry about selecting specific stocks; just choose your focus, like the geographical region, all while significantly reducing your time investment.

This diversification of risk is also much cheaper and simpler with a fund. You purchase just one title in the market: the fund share. The sample fund shown in the picture below is invested in 58 Swiss companies. Its performance depends on the performance of the underlying stocks. To achieve similar diversification on your own, you would need to purchase many different titles, which is both costly and complicated. Moreover, you cannot divide stocks into arbitrary sizes. The example fund has a 5% investment in Givaudan, whose shares cost 2,760 Francs each. It’s highly likely that you would have to exclude this stock from your portfolio.

“The purchase of individual stocks is for enthusiasts, and love can sometimes be irrational.”

In summary, buying individual stocks is for enthusiasts. If there’s a company you particularly admire, you can of course invest directly. However, the majority of your investments should be broadly diversified – opt for funds over individual securities.

Invest your money exclusively in passively managed funds

Invest your money exclusively in passively managed funds. Choose a low-cost fund. Passively managed portfolios are significantly cheaper than actively managed portfolios. There is no correlation between higher fees and higher returns.

In actively managed funds, the portfolio management actively and continuously manages the portfolio composition through actively purchasing and selling securities. It tries to exploit price fluctuations to actively exceed average market returns. Put simply, the management believes it knows better than everyone else what goes into the pot and what does not. The portfolio is thus actively composed according to the management’s assessments.

Passive funds follow a much simpler strategy. They compose their portfolio so that it replicates a market index. An index can be the Swiss stock exchange or an aggregate of the largest listed US companies. For instance, if Roche makes up 20 percent of the market capitalization of the Swiss Performance Index, then a fund that replicates this index will also give a 20 percent weighting to Roche. The portfolio is only adjusted through purchases and sales if it deviates too much from the replicated index. There are thus no endeavors to exploit supposed informational advantages, to search for under- or overvaluations. A passive fund aims to realize the return of the replicated index with a simple, cost-effective strategy.

The active management of portfolios is expensive. Firstly, high trading activity results in correspondingly high trading fees. The active management requires a specialized management team and the purchase of services, such as from analysts. This causes correspondingly high administrative costs. These costs are passed on to the investors as fees.

The crucial question is now whether these higher fees are compensated by higher returns. The answer to this is sobering: there is no empirical evidence that actively managed funds generate higher returns in the market in the long term. There are always individual funds that manage to do this over a few years – these are exceptions. The longer the observation horizon and the more funds compared, the clearer the picture: Actively managed funds do not perform better than their passive counterparts. After considering the fees, the net returns are lower than those of passively managed funds.

“There is no correlation between higher fees and higher returns.”

The theoretical justification for this has been developed since the 1960s, among others by Eugene F. Fama with the Efficient Market Hypothesis – EMH for short. It states that markets are so efficient that prices reflect all accessible information about the future.

Take, for example, a stock that is traded at 100 CHF today. New information – for example, a quarterly report or an announcement about winning a major contract – suggests that the stock price will rise to 110 CHF in the near future. Then two things happen. Any potential buyer with access to this information is immediately willing to buy the stock up to a maximum price of 110 CHF. Conversely, no seller is willing to sell for less than 110 CHF. The stock price thus immediately rises to 110 francs. This example illustrates that expectations about future price developments immediately change the current price. This argues against active management. Active management looks for under- and overvaluations. It looks for securities whose current price deviates from the expected future price – something that, according to EMH, is not possible. The reason for this is the competition for information advantages. This competition is so great that individual efforts – for example, fundamental analysis of financial reports or technical analysis of price developments – are of no use.

Fama received the Nobel Prize for his scientific contributions. His theory is still hotly debated in economics to this day. Empirical observations over several decades speak clearly for it.

The EMH confirms the recommendation in the previous section. If professional funds cannot achieve higher returns through active selection of securities – why should you? Refrain from any share-picking. Just invest in broadly diversified passive funds.

In doing so, make sure that the selected funds do not place too much weight on individual securities. Many indexes are dominated by a few large companies. The broader a fund is supported, the more diversified its risk.

The management costs of a fund are indicated as the Total Expense Ratio – TER for short. The TER is expressed as a percentage. Roughly speaking, this percentage is deducted annually from the invested assets. The less, the better.

INVEST YOUR MONEY WITH COST-EFFECTIVE INTERMEDIATES

In the two preceding sections, we have given two simple recommendations regarding financial products. Now, we will address the providers of these financial products.

To the product costs from the preceding section, trading costs are added. These include, among others, transaction fees, custody fees, and currency exchange fees. They vary significantly between different providers and can potentially consume large parts of the return.

“Fees are certain, returns are not. Do not expect better performance with higher fees.”

In recent years, there has been a lot of development in Switzerland concerning providers of investment solutions. The market is constantly in flux. Broadly speaking, today you can choose between three categories of providers. However, the boundaries between them are fluid. You will encounter a trade-off between simplicity and costs.

- You invest independently through the trading platform of a broker. On these platforms, you receive little advice, and the investment options are nearly unlimited. You have full control over your decisions. This means, however, that you must make all decisions yourself. For this, self-directed investing is by far the most cost-effective option.

- You invest through your house bank. Your house bank will traditionally offer you a limited selection of in-house products with different risks in a personal conversation. Today, you can also purchase the products online yourself – all integrated into the e-banking solution.

- You invest your money through Robo Advisors. Robo Advisors are solutions from digital providers. Based on your information about budget, risk appetite, interest, and the like, an algorithm proposes an investment strategy and a payment plan. Incoming payments are then automatically invested according to the chosen investment strategy, usually passively.

| Broker Platform | Robo Advisor | Bank | |

| Fees | low | medium | high |

| Variety & Control | high | rather low | low |

| Involvement | high | low | low |

Investing with a robo-advisor is just as easy but significantly cheaper than with your local bank. However, you forgo personal advice. We see the added value of advice from traditional banks as minimal. In the end, a product from a previously known, limited selection is sold to you at high fees. Experience shows that fee transparency is low and the advice is subject to what we believe to be a conflict of interest. With a robo-advisor, you also hardly need to make any decisions yourself. The fees are, in our experience, more transparent and more acceptable in amount.

Through online brokers, you can put together simple portfolios at a low cost. You have a wide selection of funds with the lowest possible fees. Therefore, we consider the independent purchase of fund shares from low-cost brokers to be the best option. However, this is associated with effort. You have to open an account on your own, research the products independently, make deposits yourself, and execute purchases independently. Many people are not comfortable with this. Those who lack experience, we recommend the initial determination of a portfolio consisting of a few passively managed funds – possibly with an independent advisor. In addition, set up a payment plan based on a budget. Then, at regular intervals, ideally by standing order, you deposit the amount into your securities account and use it to purchase shares of the selected funds at fixed percentages. This way, you pursue a long-term, simple, and cost-effective strategy. This process can be automated with good online brokers.

Comparing different providers is essential. Various robo-advisors have different focuses, minimum amounts, and costs. International brokers are many times cheaper in all fee categories than Swiss providers and therefore strictly to be preferred. Swiss providers are in a negative sense out of competition.

With careful provider selection and a simple strategy tailored to the provider’s fees, you save excessive and unnecessary fees. Fees that could easily melt away half of your returns. Fees are certain, returns are not. Do not waste your money on unnecessary fees. They do not stand for better products or providers.

CONSIDER TAXES WHEN CHOOSING AN INVESTMENT FUND

Taxes have a significant impact on the net return of your investment. The complexity is high due to international investment opportunities. However, Swiss investors should at least consider the following recommendations.

The Swiss authorities tax income form securities but not capital gains. In a world without taxes, it would not matter to an investor whether a company pays out a dividend or retains the money in the company. Suppose a company is valued at 100 CHF per share just before the dividend payment and wants to distribute a dividend of 10 CHF per share. At the time of the dividend payment, the share price drops to 90 CHF. The money is no longer in the company, and the company is correspondingly less valuable. Before the payment, the investor had a share at 100 CHF. Now they have a share at 90 CHF plus 10 CHF in their bank account. In Switzerland, however, the investor now pays taxes on the received dividend. On the other hand, they can sell the share tax-free in both cases. Consequently, funds that promise high dividends are not of interest to Swiss investors.

The domicile of the fund determines to what extent the respective fund can reclaim withholding tax from various countries. Funds that invest exclusively or largely in Swiss shares should have the fund domicile in Switzerland. This is because only domestic institutions can fully reclaim Swiss withholding tax. For all others, the respective double taxation agreements apply.

For international investments, the tax domicile of Ireland or the US is often preferred. Funds based in Ireland can reclaim half of the American withholding tax due to the Irish-American double taxation agreement. Since the U.S. stock market by far represents the largest share of global equity capital, the American withholding tax is correspondingly important. International brokers do not pay stamp duty in Switzerland and therefore have an additional cost advantage in addition to the already mentioned lower fees.

PURSUE A LONG-TERM STRATEGY

From the hypothesis of efficient markets, it follows that there is no right time to invest. Negative expectations should be immediately reflected in lower prices, positive expectations in higher prices on the market. If there is no evidence that professional investors can achieve excess returns in the market by actively exploiting price differences – why should you know when is a good time?

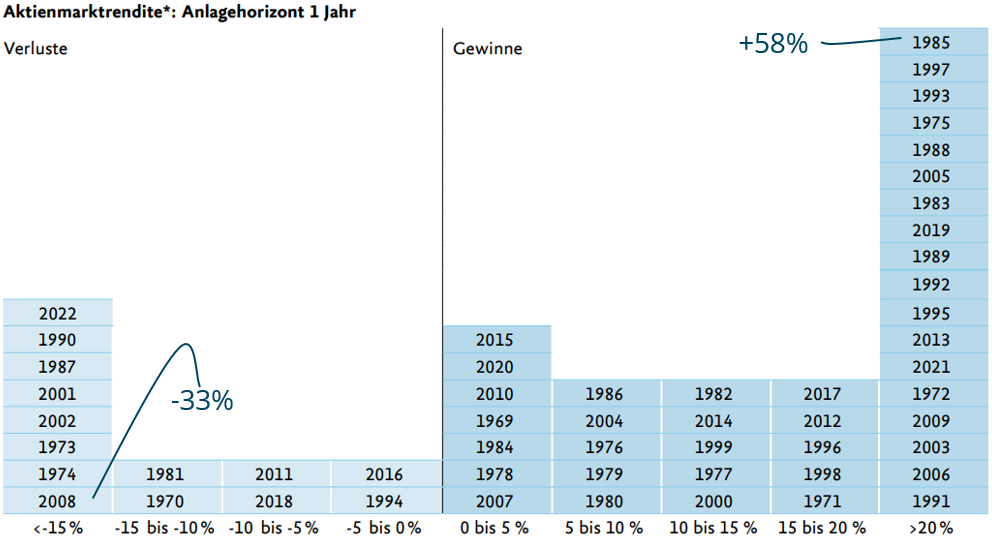

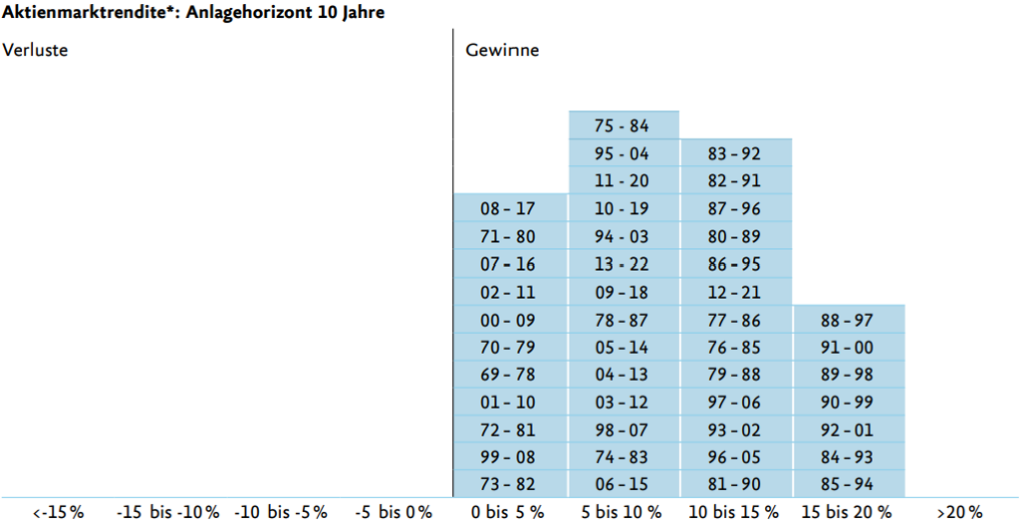

Instead of worrying about the daily highs and lows of the markets, you should devise a long-term strategy. Your investment horizon is of the utmost importance. Ask yourself how long you can do without your money. Securities are subject to strong short-term fluctuations that balance out over the long term.

We recommend simple portfolios. Adequate risk diversification can easily be achieved with a few funds, keeping your investments clear and your involvement minimal.

The mix of asset classes is determined according to your objective willingness to take risks, which is defined by your investment horizon. The longer you can do without the money, the riskier you can invest. Do not invest money that you will need in a year’s time. In addition, there is your subjective risk tolerance. After all, you should be able to sleep well even with short-term losses and not overturn everything at the first sign of turbulence. Fees and taxes are the second crucial category in product selection. Then individual preferences flow into the decision. For many, this is the desire for sustainable investments. Sustainable aspects are still hardly satisfactorily covered by simple and inexpensive fund solutions. There is a lack of standards and transparency. Inexpensive passive funds with a focus on sustainability usually just exclude those companies that perform worst in terms of environment, social responsibility, and governance compared to their industry. However, this does not make a fund sustainable. The alternative is often actively managed funds with correspondingly high fees.

“Instead of worrying about the daily highs and lows of the markets, you should devise a long-term strategy.”

Once your portfolio is set up, we recommend setting a monthly deposit amount. Ideally, you should determine your savings rate with the help of a budget. You invest this amount stubbornly into your portfolio every month. With this simple procedure, you reduce your effort considerably. You lower transaction costs and reduce your emotional involvement. The less you deal with the markets, the lower the risk of emotional actions. You can review the weighting of the portfolio once every year – that’s it.

An alternative to stubborn monthly transfers is to speculate on good investment timing – buying cheap and selling expensive. This contradicts the Efficient Market Hypothesis (EMH). However, we accept that the behavior of market participants is driven by emotions and herd behavior. Every year brings crisis days and thus favorable investment opportunities. From the announcement of the Corona lockdown to the downfall of Credit Suisse. When panic reigns, bargains beckon. Opportunistic investing is just as uncertain as predicting price developments in general. Only reserve a small part of your war chest back for such bets. Be aware that timing the market increases your involvement, your time requirement, and your stress level.

AVAILABLE FUNDS ARE FIRST INVESTED IN THE THIRD PILLAR

In Switzerland, there are tax incentives for private provision. The third pillar is tax-privileged. The rule is: the higher the cantonal tax burden and the higher the income, the more taxes you save through contributions to pillar 3a. Therefore, surplus funds from your savings rate should generally be invested first in the third pillar. The following table shows the tax savings in the city of Bern for different net incomes and a deposit of the maximum amount of 7,058 Swiss francs.

The investment horizon in pillar 3a is very long for most people. The money is blocked until retirement, with a few exceptions. Therefore, the objective risk tolerance is high. In most cases, this money should therefore be invested in pension funds and not in savings accounts.

The preceding advice also applies here. Fintech providers are waiting with attractive fees and are clearly preferable to the expensive solutions of traditional banks. Fee differences can result in asset differences of several tens of thousands to over a hundred thousand francs by retirement. A comparison is worthwhile. If you are with an expensive provider: 3a assets can be easily transferred between different providers.

| Net Income | 50’000 | 100’000 | 150’000 |

| Marginal Tax Rate | 23% | 32% | 38% |

| Tax Savings | 1’623 CHF | 2’258 CHF | 2’682 CHF |

Tax savings from depositing the maximum amount into Pillar 3a. City of Bern, single, non-denominational.

HYPES, ADVERTISING, AND UNQUALIFIED ADVICE FROM ACQUAINTANCES

The initial hype around digital trading platforms has fortunately subsided somewhat. Suddenly, friends or friends of friends speculated on stocks and much riskier financial derivatives with digital brokers. As a result, many got burned. Eventually, Bitcoins followed. The patterns repeat themselves: Fear of missing out combined with little knowledge leads to hyperactive buying and selling, poor risk diversification, disregard for fees, and inability to deal with price drops.

The streets are full of advertisements for financial products – ignore them. Ignore those guys on YouTube and acquaintances who promise quick money. If you think you’re missing out on something, ignore the impulse. You’re not missing anything. Consider investing as a marathon on a hilly course. Or to conclude with the words of the good old Warren Buffet:

“If you are not willing to own a stock for ten years, don’t even think about owning it for ten minutes.”